You're all caught up—no notifications available.

Explore All Exams at KGS

All Exams

Explore All Exams at KGS

Khan Sir Courses

Geography I Polity I History | World Map I Indian Map I Economics I Biology

UPSC & State PSC

UPSC I BPSC I UP-PSC I MP-PSC

State Exams

UP I Bihar I MP | Rajasthan

NEET | JEE | CUET | Boards

NEET | JEE | CUET | Boards

Defence Exams

NDA I CDS I CAPF I AFCAT I SSB I Agniveer

Police Exams

UP SI | Bihar SI | Delhi Police | UP Constable

SSC Exams

CGL I CPO I CHSL I MTS I SSC GD I Delhi Police

Foundation Courses

Physics I Chemistry I Biology I History I Geography I Polity I NCERT I Math I English | Map I Reasoning

Railway Exams

RRB | RPF

Teaching Exams

TET | Teaching | UGC

Banking Exams

SBI | RBI | IBPS

Engineering Exams

Civil | Electrical | Mechanical

UGC NET

UGC NET/JRF

Current Affairs provides you with the best compilation of the Daily Current Affairs taking place across the globe: National, International, Sports, Science and Technology, Banking, Economy, Agreement, Appointments, Ranks, and Report and General Studies

Syllabus:

GS2: Welfare schemes for vulnerable sections of the population by the Centre and States and the performance of these schemes.

GS-3: Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment; Inclusive growth and issues arising from it.

Context:

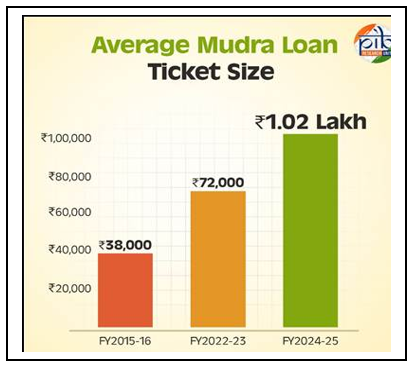

Recently, the Pradhan Mantri MUDRA Yojana completed 10 years with 53.85 crore loans amounting to over ₹35.13 lakh crore having been sanctioned, fueling grassroots entrepreneurship and expanding financial inclusion.

Pradhan Mantri MUDRA Yojana (PMMY)

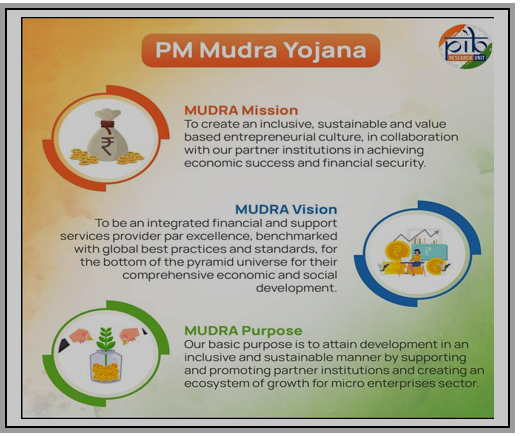

PMMY under the Micro Units Development and Refinancing Agency (MUDRA), was set up by Government of India on April 8, 2015, for development and refinancing activities relating to micro units.

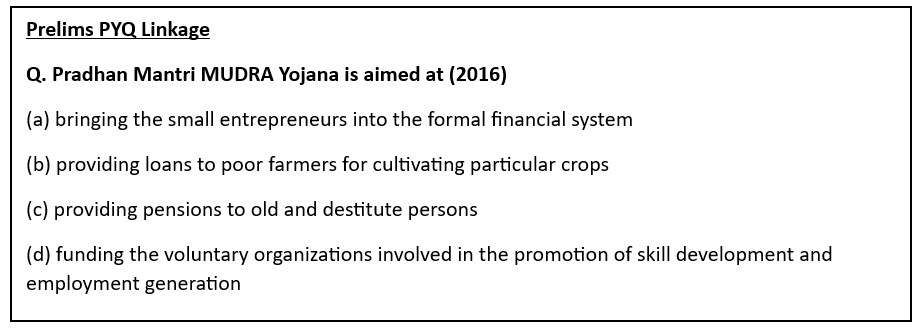

PMMY is a flagship Central Sector Scheme of the Government of India. The scheme facilitates micro credit/loan up to Rs. 20 lakhs to income-generating micro enterprises engaged in the non-farm sector in manufacturing, trading or service sectors, including activities allied to agriculture such as poultry, dairy and beekeeping.

It provides collateral-free financial support to micro and small enterprises (MSEs) across India and simplifies access fueling a nationwide entrepreneurial revolution.

PMMY covers varied sectors such as transport vehicles, community & personal services, food sector and textile sector.

Financial inclusion: Since its launch, the PMMY has sanctioned over 52 crore loans worth ₹32.61 lakh crore.

MUDRA is a refinancing institution. MUDRA does not lend directly to micro entrepreneurs / individuals. The loans under Pradhan Mantri Mudra Yojana can be availed through eligible Member Lending Institutions (MLIs), which include:

Categorisation of loans

The scheme has been classified under four categories to signify the stage of growth/development and funding needs of the beneficiary micro unit/ entrepreneur.

Mudra Card

Sources:

NCERT Books

Resources

We love learning. Through our innovative solutions, we encourage ourselves, our teams, and our Students to grow. We welcome and look for diverse perspectives and opinions because they enhance our decisions. We strive to understand the big picture and how we contribute to the company’s objectives. We approach challenges with optimism and harness the power of teamwork to accomplish our goals. These aren’t just pretty words to post on the office wall. This is who we are. It’s how we work. And it’s how we approach every interaction with each other and our Students.

Come with an open mind, hungry to learn, and you’ll experience unmatched personal and professional growth, a world of different backgrounds and perspectives, and the freedom to be you—every day. We strive to build and sustain diverse teams and foster a culture of belonging. Creating an inclusive environment where every students feels welcome, appreciated, and heard gives us something to feel (really) good about.

Get Free academic Counseling & Course Details